The Practical Guide to Company Valuation for 2025 (with Examples)

“What is my company really worth?” – This question concerns many entrepreneurs, whether for sale, succession planning or strategic decisions. In this comprehensive guide, you will find everything you need to know about calculating the company value – practical and with examples.

Table of contents

The Right Mindset

A business valuation is not a science, but the telling of a story

Calculating the value of a company is not a science and is not objective. Although one uses seemingly neutral figures, “hard facts” and makes calculations based on academic models. However, these are based on assumptions about an uncertain future. The individual valuationgive you the tools you need to put your assumptions and opinions into numbers in a consistent way. However, there is always a subjective story behind it, influenced by the author of the valuation.

The valuation will reflect what is already believe about the company

Most people involved in valuation a business already have an idea of what they think a business is worth. This preconceived opinion will find a way into the valuation. Be it through the choice of valuation, the assumptions for future growth or the selection of companies to compare with. The valuation will reflect what the creator already believes about the company. Therefore, be aware of your own biases and when considering a company valuation, always ask: Who created or paid for this valuation and what biases and motives are involved?

More complicated does not mean better

Beware of false precision when calculating the company value! The more complicated an valuation, the more ways the author will consciously or unconsciously find to reflect his bias in the valuation. If you can’t explain your business valuation someone else in a simple way, you haven’t understood it yourself.

Think in terms of bandwidths and scenarios

If possible, use at least two methods for the business valuation and look at the company value from several angles. Try to understand why different valuationproduce different results. Examine how changing assumptions and forecasts changes valuation. This will give you a sense of the possible range of enterprise value and what it depends on.

Which Valuation Method is the Right one?

How to Choose the Right Valuation Method

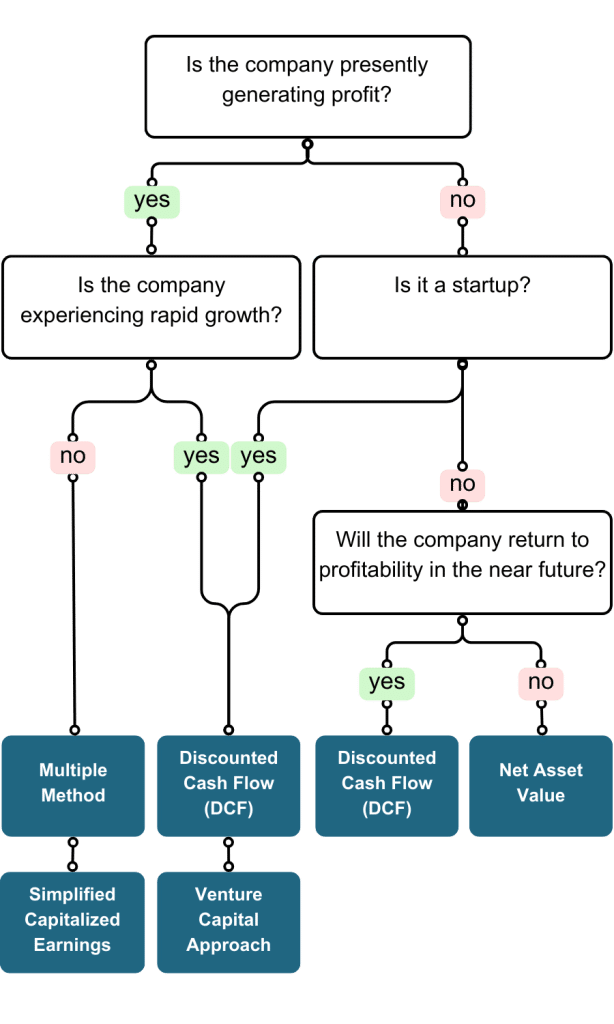

Not every valuationis suitable for all companies. The figure below shows a decision tree which helps you to choose the right valuation. If possible, use several valuation methods to obtain a range of possible company values.

The Multiplier Method and the simplified earnings value are suitable for stable and profitable companies. Its advantage is that it is simpler and easier to understand (e.g. compared to the discounted cash flow method), requires fewer assumptions and does not require a detailed profit forecast for future years. They are based on the current situation of the company. However, they cannot therefore take into account developments in the future.

The Discounted cash flow method (DCF) is very flexible and can basically be applied in any situation. However, the method is based on many assumptions and forecasts must be made for several years. Small changes can mean large fluctuations in the valuation The valuationcan also feign inaccuracy. For stable companies, the method can at best be used as a supplement to simpler methods.

The asset value only considers the current assets of a company. For a profitable company, the net asset value is significantly lower than the valuationother methods. If this were not the case, it would mean that the sale of the individual assets of the company (and thus the dissolution of the company) would make sense. The advantage of the net asset value method is that it is comparatively simple and “objective”. The asset value can be regarded as the lower limit of the company value. In certain countries, the valuation by the tax authority is based at least in part on this valuation.

The Venture Capital Method is widely used in practice for the valuation startups. It is an adaptation of the discounted cash flow method.

Multiplier Method

The valuation is based on current prices achieved by comparable companies. The selling price is considered to be a multiple of a basic key figure, such as EBIT, EBITDA or sales.

Purchase prices of small and medium-sized companies are rarely published. A comparison with listed companies is useless, as much lower multiples are usually paid for smaller companies. NIMBO publishes the currently observed EBIT, EBITDA, EBITC and revenue multiples for various countries, company sizes and industries every month. Also read the detailed explanation of the individual multiples.

Advantages and disadvantages of the multiplier method:

Simplified Earnings Value

The formula for this valuation method is: Company value = Earnings divided by capitalization rate. The capitalization rate represents that these earnings are only in the future and are subject to risk. The level of this assumed interest rate is subjective. For smaller companies, it is in the 10-20% range. Small changes in the interest rate have a large impact on the calculated company value. This capitalised earnings value method is referred to as “simple” because only an adjusted sustainable profit is assumed. One refrains from a detailed future earnings development. Of course, only profitable companies lead to positive ratings. It makes no sense to evaluate unprofitable companies using this method.

Advantages and disadvantages of the Simplified Earnings Value Method:

Discounted Cashflow (DCF)

This valuation method is closely related to the simple capitalised earnings value method described above. The interest rate is applied individually to the future cash flows (“free cash flows”) for the next 5 years. For the time thereafter, the so-called residual value is added. This is very similar to the simple income value described above. The sum of these discounted cash flows and the residual value of the company results in the enterprise value. This evaluation method is very flexible and, from a theoretical point of view, “best practice”. However, it is even more subjective and sensitive than the capitalized earnings method. Never trust a DCF valuation that you haven’t glossed over yourself. Here you can find more information about the Discounted Cashflow Method.

Advantages and disadvantages of the DCF method:

The Venture Capital Method (VC Method)

The venture capital method is a practical valuation method that is mainly used for start-ups and young, not yet profitable companies. It comes from the world of venture capitalists. At its core, an investor using this method asks the question: What could the company be worth at the exit (e.g. sale or IPO in 5–7 years)? And: What is the maximum I can invest today to achieve my desired return by then?

The investor determines a plausible company value at the time of exit – usually based on a revenue or profit forecast and a multiplier (e.g. 10× EBIT or 3× revenue). Venture capitalists expect high risks and strive for correspondingly high returns, often between 25% and 60% p.a., depending on the industry and phase. The expected exit value is then discounted with the target return over the planned holding period (e.g. 5 years). This results in the current value from the investor’s point of view, i.e. the maximum investment amount. The investor then determines their desired share of the company – this is negotiated or used as a basis for the valuation.

Advantages and disadvantages of the Venture Capital Method:

Substance value

The net asset value is obtained by first adding the values for fixed and current assets at market prices. These include balance sheet items of a tangible and intangible nature. Taxes, debts and liabilities are deducted. Hidden reserves are released. Thus, what is objectively available is evaluated. However, a buyer is usually not only interested in the substance of the company. He would like to know what profit can be generated with this substance in the future. Therefore, this valuation method is only used in combination with other methods. If the selling price is lower than the net asset value, it would make sense for the entrepreneur to simply liquidate the company. Therefore, the asset value serves as the lower limit for the company value. The asset value method is also used when other methods lead to negative evaluations.

Advantages and disadvantages of the asset value method:

The top factors for company value

Supply & Demand

There is no objective company value if you want to sell a company. Determine the company value in a sale offer and demand.

Key financial figures

Companies are valued on the basis of their expected future return. An analysis of past and present returns provides an indication of possible future developments. The returns are reviewed for sustainability. Extraordinary gains and losses are eliminated. In which direction is the trend in sales and returns pointing? Can bad years be explained?

Trust in the seller and his documents

The greater the risks, the lower the value of the company. There must be no doubt as to the accuracy and completeness of any information provided. This unnecessarily increases uncertainty. It is important to prepare all documents accordingly. These are intended to present a transparent and error-free picture of the company. Bad surprises must be avoided at all costs.

Dependence of the company on the owner

For an investor, high dependence on the owner is a risk. How does the company run if one day the current owner is no longer there? When all his experience, knowledge and relationships with customers, suppliers are no longer there?

Market position of the company

How replaceable is the company for its customers? Is an interesting niche being filled? Are there sustainable competitive advantages? A clear focus, an excellent reputation and long-standing customer relationships are hard to copy.

Risks

A balanced customer base, replaceable business partners and low dependence on individual employees reduce the risk.

Growth prospects

Is the business model geared towards growth? What are the opportunities for a potential buyer? Are there attractive economies of scale?

Staff

What is the employee turnover rate? What’s the sick rate? What is the age structure? How sought after are the employees on the labour market?

Avoid these 5 Common Mistakes

Bias

Company owners understandably find it difficult to look at their own company objectively. Price expectations are often too high. So ask yourself: would you buy the company yourself at that price? Couldn’t you build a new company with that amount of money? How long would it take for a buyer to refinance the sale price in the form of profits? Tip: No one wants to be in the red 8 years after buying a company.

No market wage for the owner

A profit is only really a profit if all employees – and that includes the CEO! – were paid in line with the market. Anything else is a distortion of the earnings situation, which leads to an excessively high valuation.

Orientation towards large companies

The market leader in your industry is valued at three times sales? Amazon was worth billions before it even turned a profit. The EBIT multiples of listed companies are often in double digits. For companies with less than 20 million in sales, however, EBIT or EBITDA multiples between 3-6 are the rule. In our overview you will find realistic valuation multiples for a company of your size and your industry. Is your company the rare exception? Then you will notice this through regular, unsolicited and concrete offers to buy.

“Full Warehouse” and “Expensive Machinery”

Most valuation methods are based on the firm’s earnings. The company is seen as an instrument for generating future profits. Everything that is needed to be able to generate these profits in the future has already been taken into account. This includes machinery, warehouse, innovative products, etc.. If these things do not provide a higher profit in the future, they are worthless from this point of view. However, many owners would like to add, for example, the stock of goods to the income value of the company. That is not appropriate with these methods. (Thoughts on valuation of the warehouse when selling the company)

“The company has a lot of potential”

Almost every company has “still a lot of potential”. Taking advantage of this requires a lot of entrepreneurial spirit and resources and should therefore be cautiously factored into the valuation. If you want to exploit the full potential of the company, you should do this yourself and only sell the company later. No one believes a salesperson that the company is about to take a big leap in profits. So why would he want to sell at this exact time?

The Process of a Company Valuation

1) Cleaning up the accounting records: the financial statements of the last 3-5 years are normalized. Extraordinary income and expenses, non-operating expenses, hidden reserves and tax optimizations are eliminated. Entanglements with the private life of the owner are resolved. If necessary, salaries from the owner or other related parties that are not in line with the market are adjusted. The resulting financial figures should reflect as accurately as possible the sustainable earnings position of the company, which is also realistic under new ownership.

2) Create projected numbers for the next 3-5 years (preferably for different scenarios).

3) Evaluation using the various common evaluation methods, taking into account the previous points.

5) Mix of the individual methods for the formation of average values and ranges, also taking into account different scenarios and assumptions.

If it Needs to be Done Quickly

Rule of thumb business valuation formula

Would you only like an indication of the company value of a small or medium-sized company based on a rough company valuation formula?

- Calculate company value Rule of thumb 1: Calculate the average of the EBIT (earnings before interest and taxes) of the last three years. Multiply this by a factor of 4 (low value) to 6 (high value). Subtract debts of the company from the results. You will receive a range in which your company value is approximately located.

- Calculate company value Rule of thumb 2: Consider the amount of profits a buyer could take out of the company over the next few years. Set the price so that it can amortize the purchase price within 4 to 7 years.

You can find an overview of common rules of thumb in our blog post on the topic.

Calculate the value of a company with online services

An online company valuation can provide a good initial indication of a possible selling price. However, a specialist should always be consulted for a definitive price determination.

Characteristics of a good online company evaluation

- Systematic guidance through a structured questionnaire

- Understandable for non-experts

- Financial figures can be adjusted

- Calculation of company value based on current market data

- Takes different industries into account

- Takes into account different company sizes (a company with 5 employees is valued differently than one with 50 employees)

Online Company Valuations are NOT Suitable . .

- … for the valuation of startups

- … to calculate the value of a company that is growing very quickly

- … to calculate the value of a company if it is making a loss or very little profit (take a look at our tips on valuing non-profitable companies)

Beware of marketing tricks!

Many online calculators have only one goal: to generate leads for company sales. They suggest that you get an automatic evaluation after the questionnaire. At the end comes the surprise: you have to enter your contact details and a “subject matter expert” (salesperson) will get back to you by phone.

Industry-specific Features

The basic valuation is more or less identical for all companies, but depending on the industry there are special features that need to be considered. Does your company belong to one of the following industries? Then take a look at our blog posts that deal with the special features of valuing companies from these industries.

Relevant value drivers in this industry are: switching costs for the customer to another provider, the marginal profit and contractually recurring revenues.

Relevant value drivers in this industry are: the rights to the intellectual property of the products, production in large quantities, a standardized product range, a high proportion of self-provided added value and the age of the machinery.

Relevant value drivers in this industry are: sales channels, the proportion of private labels, the organic proportion in new customer acquisition and the customer loyalty and repurchase rate.

Relevant value drivers in this industry are: the supplier structure, the amount of the trading margin, the inventory turnover rate, the proportion of private labels and the exclusive rights to the products.

Maximize Company Value before Sale

A number of things can be done before the sale to reduce uncertainty and highlight the strengths of the business. This maximizes sales price.

Distribute knowledge, document processes, define deputies

This can minimize the potential damage if a key employee drops out or leaves the company. This alleviates a major concern of a potential buyer.

Ensure customer and supplier relationships

A buyer will be concerned about losing important customer or supplier relationships after the owner leaves.

- Transfer important relationships to employees who are likely to stay with the company.

- If possible, secure customer relationships through service agreements and loyalty programs.

- Identify alternatives for key suppliers to mitigate risk for default and price increases.

Optimization of receivables management

Reduce capital tied up in current assets. This will directly increase the company value. Shorter payment terms for customers and a consistent dunning system should be examined.

Prepare annual balance sheets

The annual financial statements of the last 5 years must be prepared in a transparent and easily understandable manner. Fluctuations in sales, slumps in profits, conspicuous jumps in costs, etc. must be able to be explained conclusively when asked. This creates trust and increases planning reliability.

Well-known references document

Get references from reputable and satisfied customers and include them in sales materials.

Convincing formulation of market advantages

What makes the products or services unique in the market? What is hard for the competition to copy? Focus on what’s important and get to the point. Include the formulated benefits in the sales documents.

Create a plausible growth plan

Identify realistic and concrete potentials for further growth and increased efficiency and show concretely how these can be realized. Also, be prepared to ask yourself why you haven’t already implemented them yourself.

Anticipate and prepare further information needs of the buyer

The greater the uncertainties and doubts of the buyer, the lower the purchase price. Build trust with well-documented, clear, complete answers to anticipated questions.

Clarify unresolved employee claims

Clarify and document all claims to bonuses, holidays, promised wage increases, etc. Avoid negative surprises for the seller.

secure premises

Increase planning security by securing long-term leases for your premises, renegotiating with the landlord if necessary.

Clarify internal conflicts

Disputes should be resolved and bad moods in the team should be improved. The sales process and the transition phase are demanding and the owner is dependent on the support of the employees.

Prepare the premises

The eye makes a judgment:

- Cleaning of the premises

- Carrying out renovations that are due

- Ensure compliance with legal requirements

- Sale or disposal of redundant machinery and inventory

- destocking

Update the company website

Avoid an outdated or unprofessional web presence.

Valuation Depending on the Growth Phase

Rate startups

Valuing startups is even more subjective than valuing established companies. One evaluates exclusively a promise for the future. We have compiled a list of criteria for the valuation.

Important terms: pre-money vs post-money valuation

When a startup closes a funding round, money flows into the startup’s bank account. The value of the company thus increases by this amount of money. It is therefore important to be clear in a valuation whether one is talking about a “pre-money” valuation (value before the financing round) or “post-money” valuation (value after the financing round).

Expected return from investors for startups

Startups are risky investments. That is why investors expect a high return. The earlier the financing phase, the greater the risk and thus the expected return. The expected return is needed for the DCF and VC methods.

| Financing phase | Expected return / discount rate | Expected payback in 5 years |

|---|---|---|

| 1 Seed Stage (foundation) | 70-90% | 20x |

| 2 Start-up Stage (before market launch) | 50-70% | 10x |

| 3 First Stage (Successful Market Entry) | 40-60% | 8x |

| 4 Second Stage (Expansion) | 35-50% | 6x |

| 5 Later Stage (positive cash flow) | 30-40% | 5x |

Source: Venture Valuation, Lecture_IF-Unternehmensbewertung_2012.pdf, Slide 29

Discounted Cash Flow Method for Startups (DCF)

The DCF method described above can be applied to business plans of startups. The discount rate used is derived from the investors’ expected return (see table above).

Venture Capital Method (VC Method)

This method is simpler than the DCF method. One uses the simple multiplier method. This is really only suitable for established, profitable companies. If the company is not yet making a profit, there is nothing to multiply. That’s why the first step is to imagine that everything is going exactly as in the business plan. The multiplier method is then applied to the projected numbers in, e.g., 5 years. This then gives the hoped-for value in 5 years. Whether this scenario will exactly occur is, of course, very uncertain. The future value is therefore extrapolated back to the present using investors’ expected returns (see table above).

Example: A startup (first stage) expects to exit in 5 years. The expected profit in 5 years is 1 million. According to the multiplier method, the company would then be worth 6 million. The investors expect an annual return of 40%. So the value of the company must increase by 40% every year. It must be calculated back with the following calculation: 6.0 m / (1 + 40%) ^ 5 = 1.1 m. The company thus receives a post-money valuation of 1.1 m.

Glossary: Important terms in business valuation

DCF

Stands for “discounted cash flow”. The DCF method is a frequently used valuation method.

Derivative goodwill

Derivative goodwill is the difference between the actual purchase price of a company and its intrinsic value. The value is reflected in the accounts of a company that has bought another company. It corresponds to “goodwill” and “goodwill” from an accounting perspective. If the value is not derived from a purchase price but is estimated, this is referred to as “original goodwill”.

enterprise value

The total value of the firm from the perspective of equity and debt investors. In contrast to the equity value, debt capital is not deducted. The value allows a comparison between companies with different capital structures.

equity value

The value from the equity investor’s perspective. Equity value equals enterprise value minus debt plus cash reserves.

Company value

In practice, this value is often equated with the total value of the company. From an accounting point of view, “goodwill” refers only to the part that exceeds the net asset value (see “net asset value”) in the event of a sale. Synonymous with “goodwill” and “derivative goodwill”.

Goodwill

See “Derivative goodwill”.

Intangible assets

Intangible assets are assets that are included in a company’s balance sheet but are not physically tangible. These include, for example, patents, trademarks and licenses. The total constitutes the intangible value of the company.

Material value

Physically tangible assets such as machinery and inventory.

Original goodwill

The original goodwill is the difference between the self-assessed total goodwill and the net asset value. It cannot be reflected in accounting. In contrast to derivative goodwill, the value is not derived from an actual sales price but is estimated. It may therefore not be included in the balance sheet.

Pre Money Valuation

Refers to the value of a start up before raising an additional round of funding.

Post Money Valuation

Refers to the value of a start up after new money has been infused into the company.

Substance value

Frequently asked questions

What makes a good company valuation tool?

It should be well-structured, easy to understand and comprehend, take into account different industries and company sizes, and be based on current market data.

Are online company reviews for everyone?

Unless specifically stated otherwise, they are NOT suitable for an initial indication of startups, fast-growing companies, and companies that are loss-making or marginally profitable.

Calculate the value of a company: Which is the best method?

The individual methods have strengths and weaknesses. You should not rely on just one method. A mix of different methods, played through several times with varying scenarios, gives a feel for the possible range of the company value.

Can I calculate the company value with a rule of thumb business valuation formula?

Rule of thumb business valuation formula 1: Multiply the average EBIT of the last three years once by four and once by six. Subtract debts of the company from the results. You will receive a range in which your company value is approximately located.

Calculate company value Rule of thumb 2: Consider the amount of profits a buyer could take out of the company over the next few years. Set the price so that it can recoup the purchase price within 4 to 7 years.

How do you deal with real estate when determining the value of a company?

If you want to calculate the value of a company that owns real estate, they are usually valued separately and then added together. Often, when a property is sold, it is first spun off and then leased to the buyer. In this case, the company’s historical financial figures are adjusted by deducting a hypothetical fair market rent. Expenses for the maintenance of the property, on the other hand, can be added to the profit. Are you not sure whether you should sell the property together with the company? A list of the factors to consider.

What do investors pay particular attention to during the company valuation?

Link to the list with the 10 critical factors that investors pay attention to during a company valuation

What is different when valuing a franchise company?

Here, not only is a single company valued, but an entire system. We have put together the most important points.

What are Add Backs?

Add-backs are adjustments made during the company valuation to get a fairer result. What types of add-backs are applied can vary from case to case, depending on the individual circumstances of the company. An overview

Which key figures provide information about the performance of a company?

The performance of a company can be assessed using a variety of key figures that reflect different aspects of the company. For an overview of the most important key figures